The New Battlefront: Why Plaintiffs’ AI Tech Threatens Insurers —And What to Do About It

By Dwayne Hermes

The legal tech industry is witnessing a seismic shift with the emergence of platforms like EvenUp, which leverage AI to optimize personal injury claims management for plaintiffs.

This evolution presents both challenges and opportunities for the insurance sector, especially in managing litigated claims more effectively. This paper explores the implications of EvenUp's innovations on the insurance industry and introduces ClaimDeck's capabilities as a strategic countermeasure to ensure balanced claim outcomes.

The Rise of EvenUp in Legal Tech

EvenUp has rapidly transformed into a powerhouse within the legal tech space, marked by its recent $135 million funding round, bringing its valuation to over $1 billion. This investment reflects confidence in EvenUp's ability to close the justice gap through advanced AI technologies that enhance case outcomes for personal injury law firms.

EvenUp's platform, powered by its AI model, Piai™, has introduced revolutionary products that streamline case preparation, negotiation, and settlement processes. These tools have dramatically improved efficiency and effectiveness in personal injury litigation, setting new standards in legal practice and claim settlements.

Challenges for the Insurance Industry

EvenUp's advancement poses significant challenges for insurers:

Increased Plaintiff Efficiency: EvenUp’s tools help law firms optimize their case strategies and document management, potentially leading to higher claims against insurers.

Data-Driven Plaintiff Negotiations: With AI-powered insights, plaintiffs can negotiate more effectively, often securing better settlements that could increase the overall claim costs for insurers.

Rapid Adoption by Law Firms: The swift adoption of such technologies by plaintiffs' attorneys pressures insurers to equally leverage advanced tech to balance the negotiation scales.

ClaimDeck: An Insurer’s Strategic Tool

In response to the evolving legal tech landscape, ClaimDeck offers a robust platform designed to equip insurers with advanced tools to manage and negotiate litigated claims effectively:

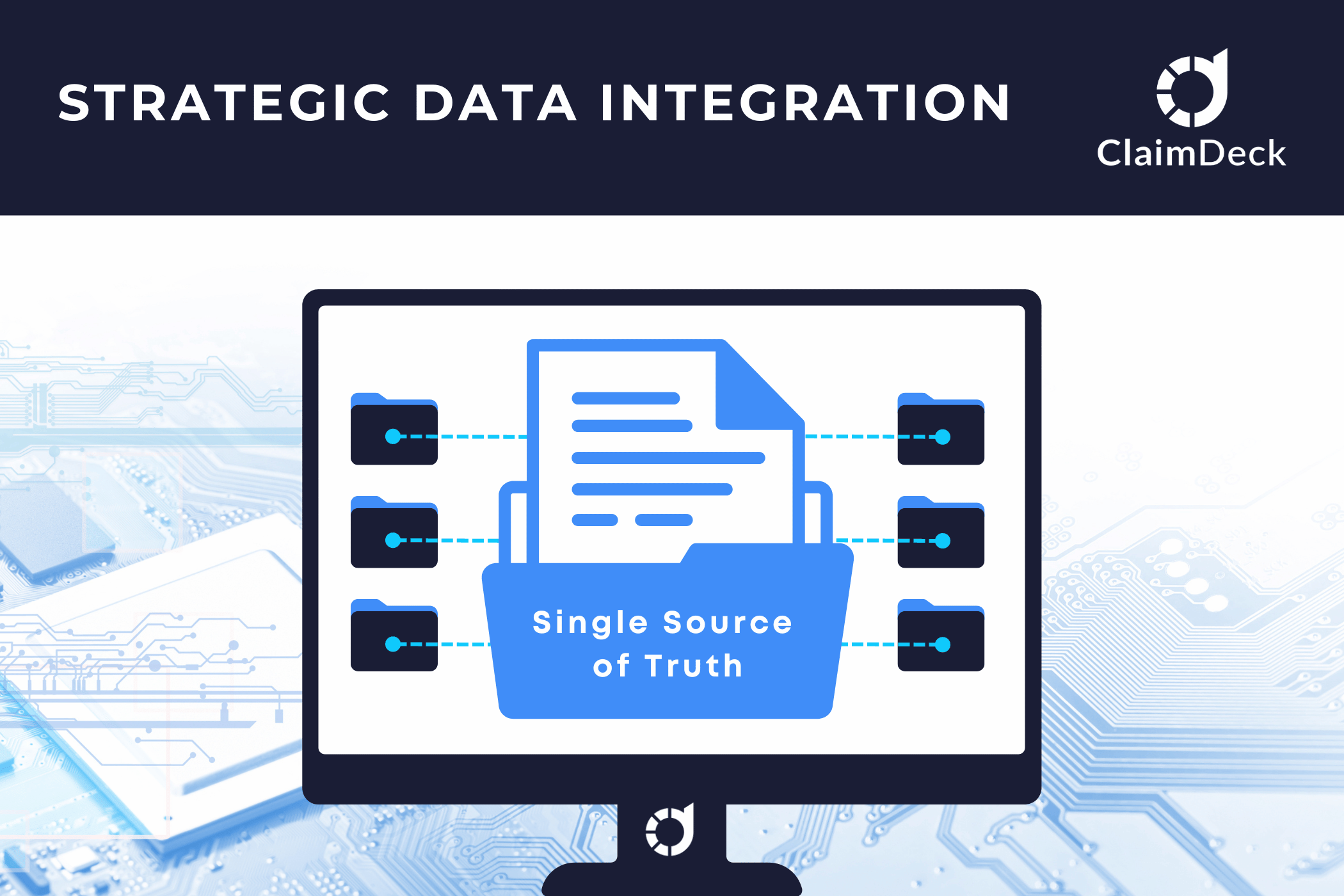

Data Integration and Accessibility:

Similar to EvenUp's integration capabilities, ClaimDeck consolidates all case-related data within a unified platform, enhancing visibility and strategic planning for insurers.

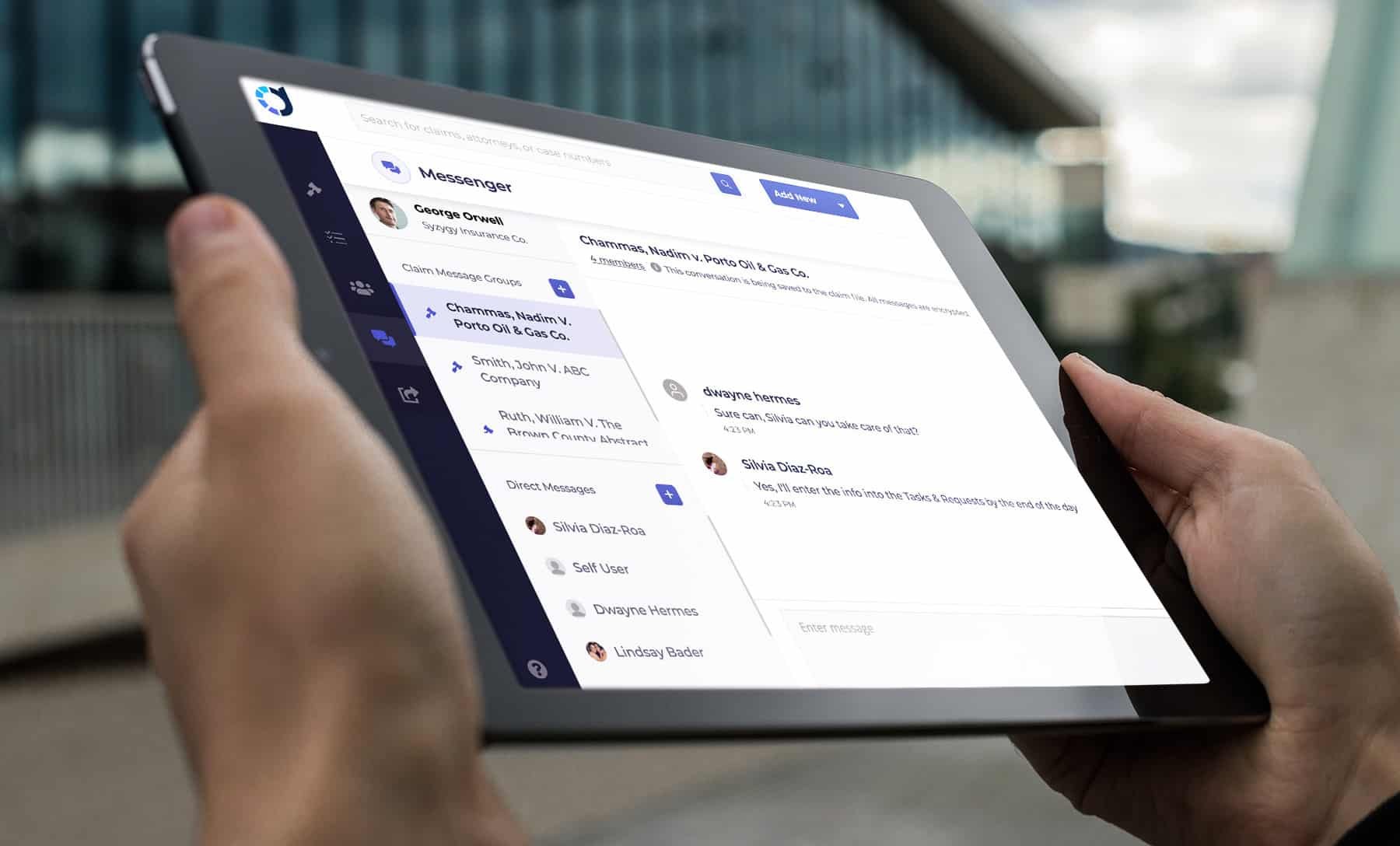

Enhanced Communication Tools:

Facilitating real-time updates and transparent communication between claims adjusters and defense attorneys, ensuring all parties are aligned and informed, countering the enhanced plaintiff preparations.

Workflow Optimization:

ClaimDeck’s workflow tools, such as the “Milestones & Events” feature, allow insurers to proactively manage case timelines and critical tasks, mirroring the plaintiff side’s efficiency.

Strategic Claims Management:

By offering features that streamline the management of claims from inception through resolution, ClaimDeck ensures that insurers can maintain or regain parity in negotiations influenced by plaintiff-side AI advancements.

Strengthening Insurers in the Legal Tech Era

The rapid growth and capabilities of EvenUp underscore a pivotal development in legal tech that significantly impacts the insurance industry. However, with tools like ClaimDeck, insurers are not left at a disadvantage. ClaimDeck’s platform equips insurers with the necessary technology to respond effectively to the heightened capabilities of plaintiff’s attorneys, ensuring a balanced approach to litigation management.

By adopting advanced technologies like ClaimDeck, insurers can not only mitigate the challenges posed by platforms like EvenUp but also enhance their own operational efficiency and effectiveness in claim outcomes.

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.