Smarter Claims, Smarter Costs: The Power of ClaimDeck’s Per-Claim Pricing

By Dwayne Hermes

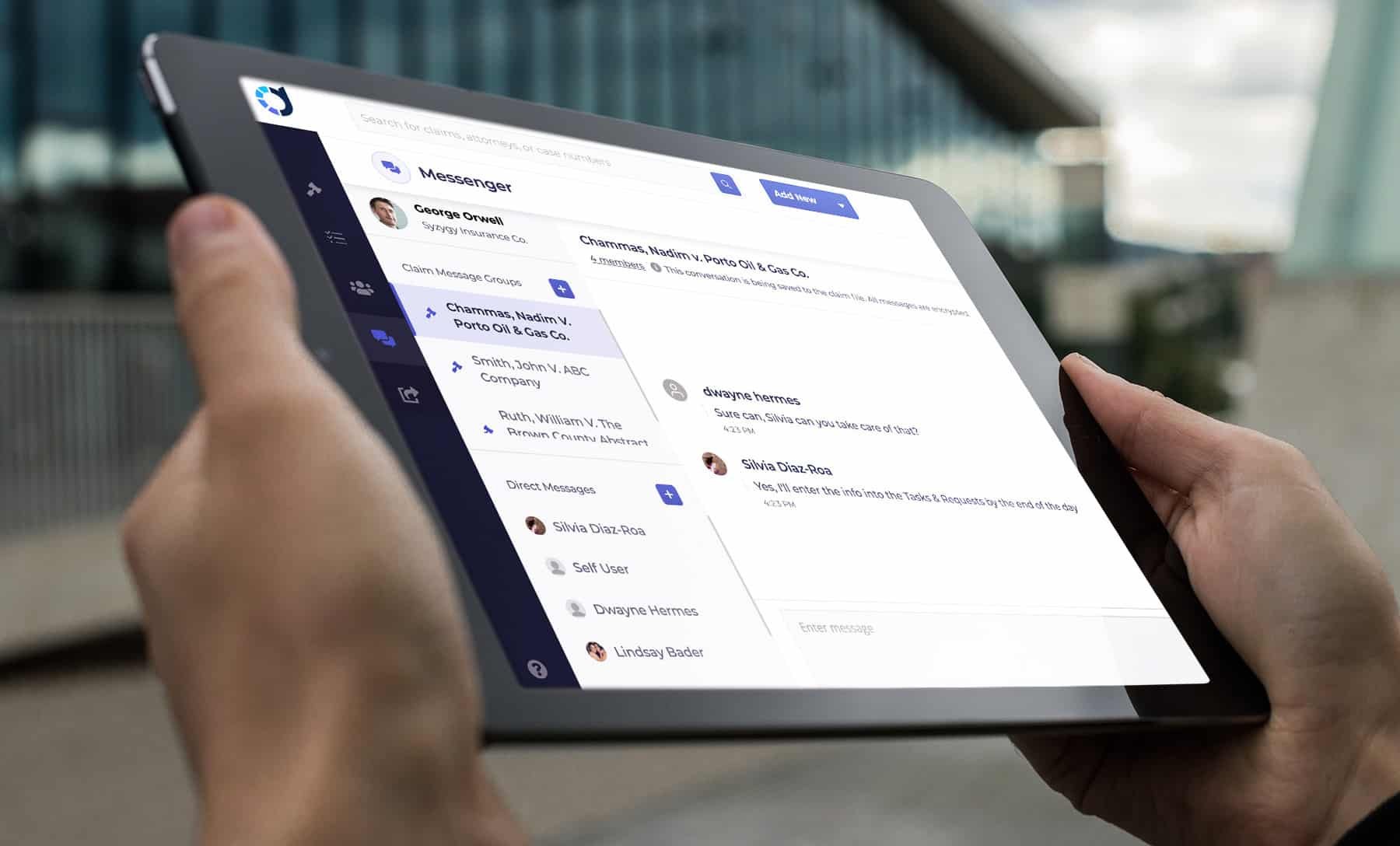

In today's competitive insurance landscape, efficient claims management is paramount. ClaimDeck, a web-based platform, offers a transformative approach where claims professionals and attorneys collaboratively handle litigated claims. By utilizing a per-claim pricing structure, ClaimDeck not only streamlines claims processes but also provides a significant financial advantage to its customers.

This white paper explores how ClaimDeck’s per-claim pricing structure enhances profitability, operational efficiency, and regulatory compliance for insurance carriers.

Understanding Allocated Loss Adjusting Expenses (ALAE)

Allocated Loss Adjusting Expenses (ALAE) are expenses directly associated with the handling of specific claims. These include legal fees, investigation costs, and other claim-specific expenditures. By categorizing these expenses accurately, insurers can gain a clear picture of the costs involved in resolving individual claims, leading to better pricing and reserving practices.

Benefits of ClaimDeck’s Per-Claim Pricing Structure

Accurate Cost Allocation and Pricing

ClaimDeck’s per-claim pricing structure allows insurance carriers to allocate expenses precisely to individual claims. This accurate cost allocation enables insurers to:

Justify Premium Increases:

By demonstrating the direct link between ClaimDeck expenses and specific claims, insurers can provide detailed premium adjustments, facilitating regulatory approval.

Source: NAIC reports on expense allocation and regulatory compliance highlight the importance of accurate cost tracking.

Enhance Financial Stability:

Accurate allocation ensures that premiums reflect the true cost of claims, supporting financial stability and profitability.

Source: Industry analyses emphasize the role of precise expense allocation in maintaining insurer profitability.

Improved Claims Management and Efficiency

ClaimDeck enhances claims handling efficiency, potentially reducing overall claims costs. Benefits include:

Faster Settlements:

Streamlined communication and collaboration between claims professionals and attorneys expedite the settlement process.

Example: Faster settlements can lower legal fees and other associated costs, contributing to overall cost reduction.

Better Resource Allocation:

Detailed expense tracking helps insurers identify high-cost claims and allocate resources effectively to manage them.

Expense tracking by claim allows the insurer to balance the detail of each claim, but also a market level portfolio view of litigated expense allocation.

Source: Industry studies on claims management efficiency underscore the benefits of targeted resource allocation.

Competitive Advantage in the Marketplace

The ALAE cost structure approach allows for an accurate cost per claim service fee as part of the premium structure, allowing for a lower loss ratio:

Value-Added Services:

ClaimDeck’s platform improves claims handling processes, offering better service quality.

Example: Emphasizing the value of efficient claims management and improved customer service can help retain and attract customers.

Technology-Driven Efficiency:

Leveraging ClaimDeck’s technology reduces administrative overhead, balancing out ALAE and maintaining competitive pricing by reducing litigation expense and indemnity.

Source: Analyses on the impact of technology in claims management highlight the efficiency gains from such platforms.

Regulatory Compliance and Justification

Accurate expense allocation through ClaimDeck supports regulatory compliance by providing clear data for rate filings:

Detailed Reporting:

ClaimDeck’s per-claim pricing structure offers comprehensive data, making it easier to validate price and rate to regulators.

Source: NAIC guidelines on rate filings stress the importance of detailed and transparent expense reporting.

Enhanced Rate Filings:

Detailed cost tracking allows for more precise rate filings, ensuring rate increases are well-supported.

Example: Insurers can provide regulators with robust data showing the necessity of premium adjustments based on actual costs.

ClaimDeck’s Per-Claim Pricing: Driving Profitability, Efficiency, and Long-Term Success

ClaimDeck’s per-claim pricing structure offers substantial benefits to insurance carriers, including accurate cost allocation, improved claims management, and enhanced regulatory compliance. By leveraging these advantages, insurers can maintain profitability and competitiveness in the marketplace while delivering superior claims handling services. ClaimDeck not only supports better financial performance but also positions insurers for long-term success in a dynamic industry.

About ClaimDeck

ClaimDeck is a leading web-based platform that brings together claims professionals and attorneys to manage litigated claims efficiently. With its innovative per-claim pricing model, ClaimDeck is dedicated to transforming claims management and driving value for insurance carriers.

Sources:

NAIC Reports on Expense Allocation and Regulatory Compliance

Industry Analyses on Claims Management Efficiency and Financial Stability

Regulatory Guidelines from State Insurance Departments

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.