The AI Advantage: Transforming Insurance Claims for the Future

By Dwayne Hermes

The rapid evolution of AI technologies, particularly in the legal and insurance sectors, demands a strategic response from insurance claims departments. As AI tools transform competitive dynamics and operational efficiencies, insurance companies must not only adapt but also anticipate future challenges.

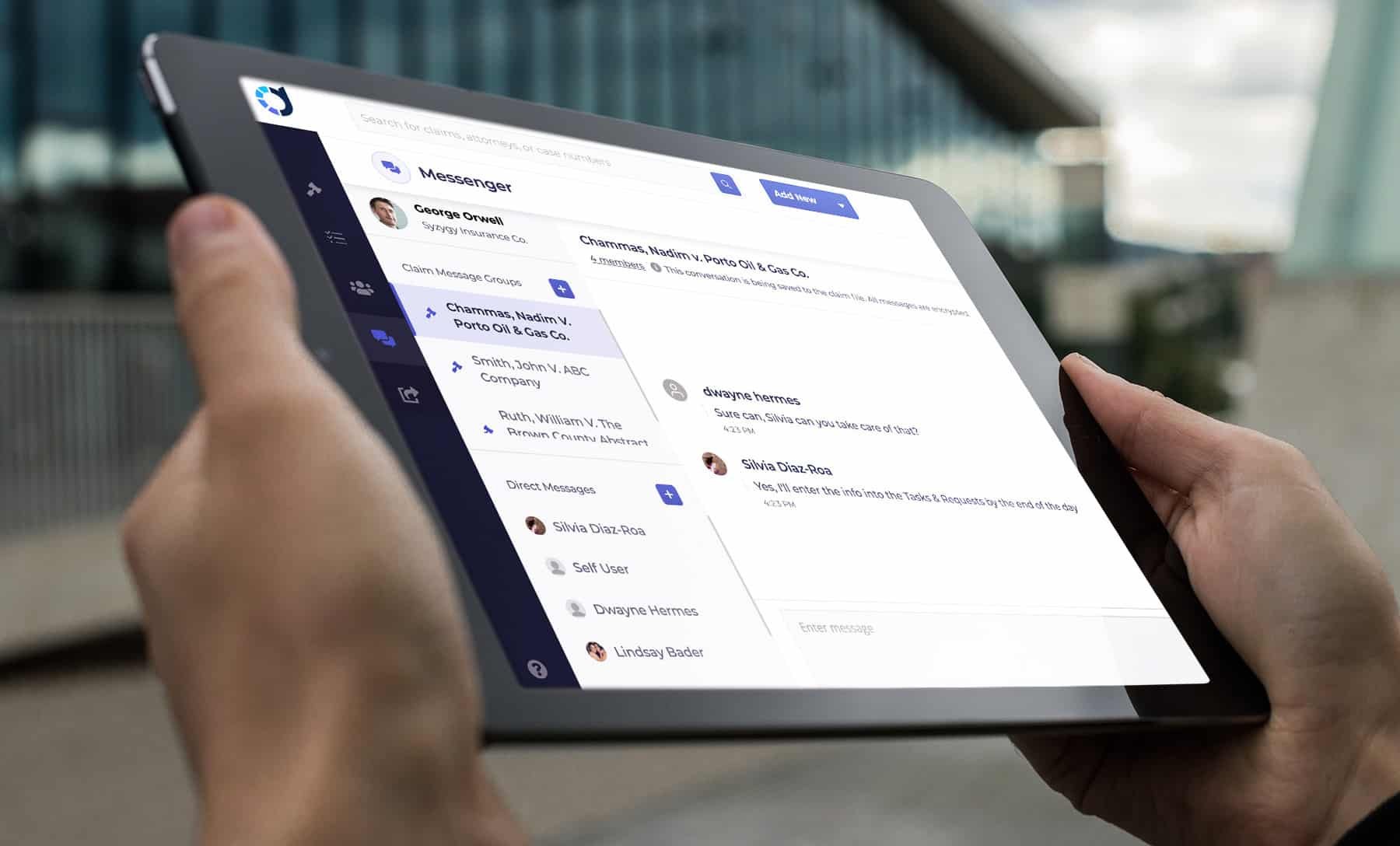

This paper outlines the strategic importance of adopting advanced litigation management technologies like ClaimDeck, and the necessity of preparing for a more extensive integration of generative AI in the insurance landscape.

The Current State of AI in Insurance Claims Management

Insurance claims departments are increasingly encountering AI-driven tools that promise enhanced efficiency and decision-making capabilities. Claims management software, especially those enhanced with AI capabilities, are pivotal in transitioning traditional claims processes into more streamlined, data-driven operations. The emergence of generative AI tools has further amplified the potential to transform claims handling, risk assessment, and customer service.

Generative AI’s Impact and Industry Response

With the introduction of platforms like the plaintiff’s-attorney-focused, EvenUp, the legal sector illustrates a significant shift towards utilizing AI for complex tasks such as case preparation, negotiation strategies, and predictive analytics.

This shift is not just a trend but a clear indication of how deeply AI is being woven into the fabric of legal operations, affecting related industries including insurance. EvenUp's success highlights the critical role of data and AI in enhancing the efficiency and effectiveness of case management, setting a precedent that the insurance industry can learn from.

Challenges and Opportunities for Insurance Claims Departments:

While the potential benefits of AI in claims management are vast, the path is fraught with challenges. These include integrating AI without disrupting existing workflows, ensuring the quality and integrity of AI-generated recommendations, and managing the change within the organization.

However, these challenges are outweighed by opportunities to significantly reduce cycle times for claims processing, improve accuracy in risk assessment, and enhance customer satisfaction.

Framework for AI Integration in Insurance Claims

Develop a clear, long-term strategy for AI integration that aligns with business goals.

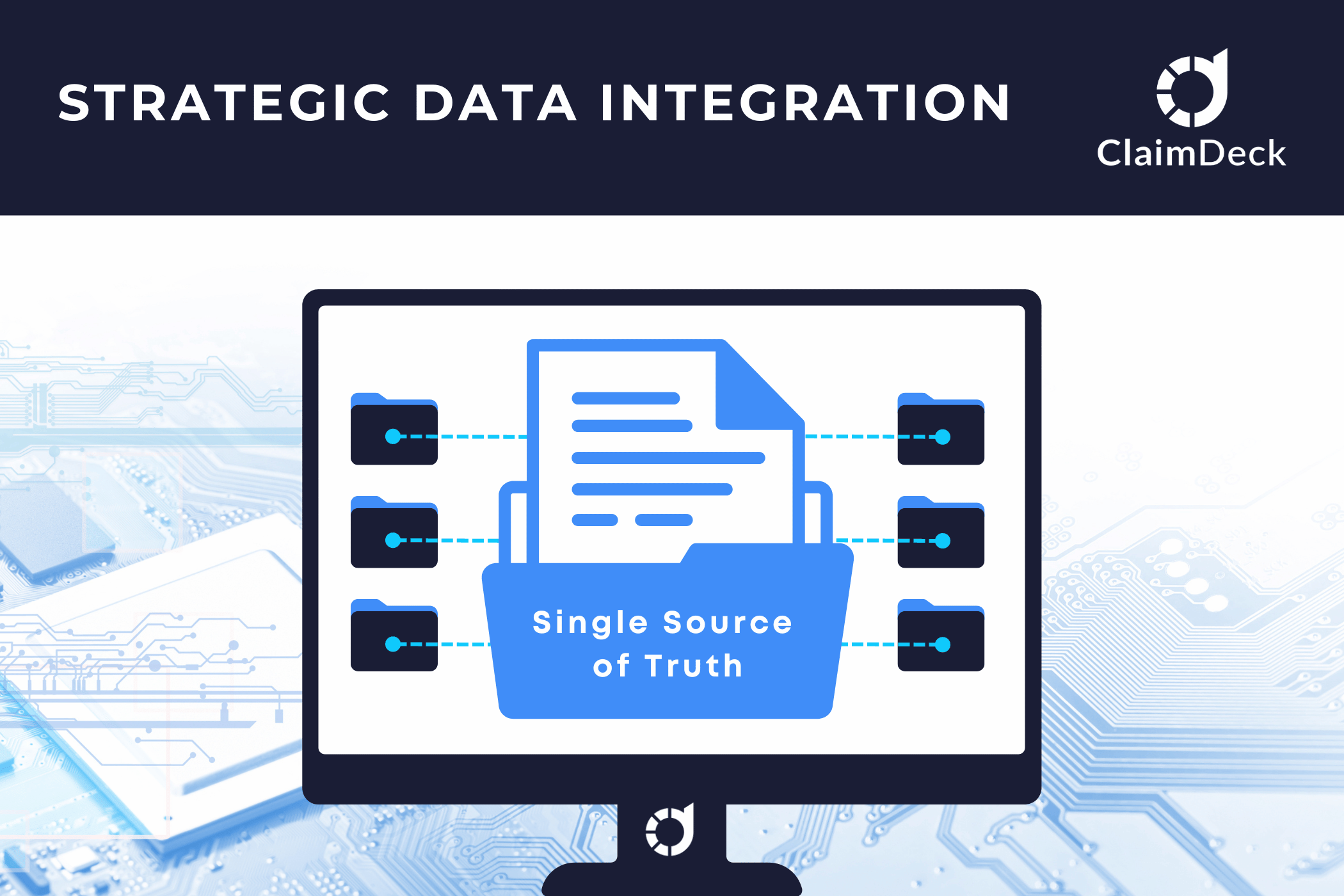

Invest in systems like ClaimDeck to capture and organize essential data which will fuel AI tools.

Equip staff with necessary skills and understanding of AI tools to leverage new technologies effectively.

Address ethical considerations and comply with emerging regulations concerning AI use.

Case Study: ClaimDeck’s Role in Facilitating AI Readiness

ClaimDeck’s capabilities in capturing structured data on a per-claim basis are indispensable for insurers aiming to utilize AI effectively. By providing detailed, actionable data, ClaimDeck not only enhances current claims processing efficiencies but also sets the groundwork for integrating more complex AI applications, including predictive analytics and automated decision-making.

ClaimDeck provides detailed and actionable data.

Legal Tech Insights from EvenUp’s Growth

EvenUp’s trajectory in the legal tech market emphasizes the importance of proactive adoption of AI technologies. The success of EvenUp’s generative AI tools in transforming legal case management can serve as a blueprint for insurance claims departments. The lessons learned from the legal domain about both the potential and pitfalls of AI are directly applicable to the insurance industry, particularly in claims litigation management.

Embracing the Future of Claims

The insurance claims landscape is evolving rapidly, driven by advancements in AI and generative technologies. Platforms like ClaimDeck are at the forefront of this transformation, empowering claims departments with data-driven tools to streamline workflows, enhance decision-making, and set the stage for future AI integrations. As seen in the legal sector's adoption of AI tools like EvenUp, early adopters gain a significant competitive edge.

By leveraging ClaimDeck’s capabilities to capture and organize structured data, insurers can unlock the full potential of AI while addressing operational challenges. The future of claims management belongs to those who embrace innovation—and ClaimDeck is here to help lead the way.

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.