Enhancement of Claims Management —A Comprehensive Strategic Plan

By Dwayne Hermes

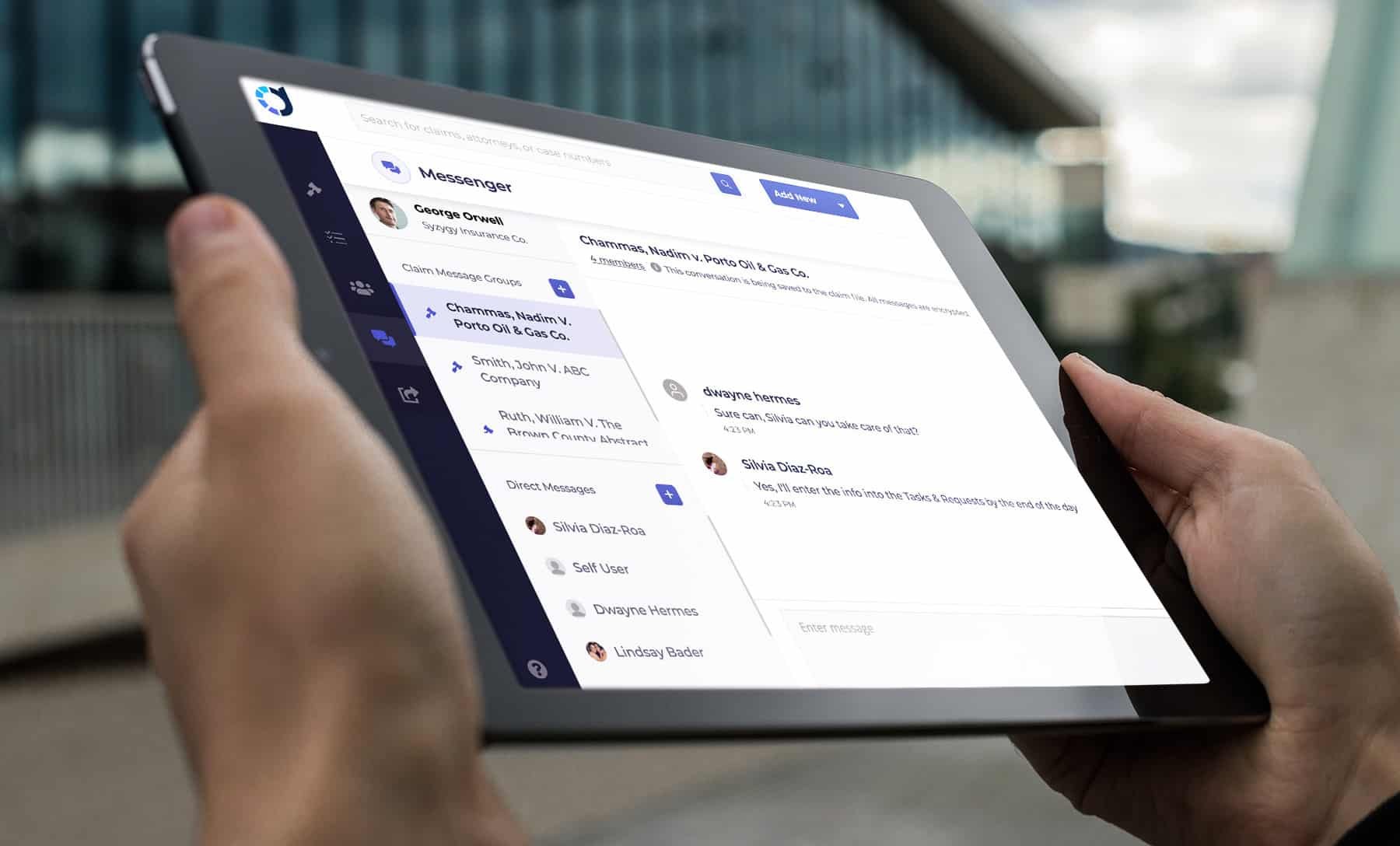

In advising the Chief Claims Officer (CCO) of a carrier on strategic planning, it’s essential to emphasize the transformative role of litigation management technology. This technology not only streamlines litigation processes but also collects hundreds of categories of structured data, unique to the platform, offering unparalleled insights into claims litigation. The integration of this technology should be viewed as a pivotal component of the claims department’s strategic plan, enhancing technology adoption, data strategy, analytics capabilities, and the utilization of AI and InsurTech innovations.

The ClaimDeck Risk Industry Ecosystem

Elements of a Forward-Thinking Claims Department Strategic Plan

1. Technology Enhancement Plan:

Adopting litigation management technology is crucial in an environment where InsurTech offerings are rapidly evolving. This plan should prioritize solutions that enhance operational efficiency and seamlessly integrate unique data insights into the broader claims management ecosystem.

Action Items:

Implement litigation management technology that provides unique structured data, enriching the carrier's understanding of litigation processes.

Conduct a technology audit to identify integration opportunities for enhancing existing systems with unique data insights from the litigation management platform.

Collaborate with InsurTech firms to leverage complementary technologies effectively alongside the litigation management platform.

2. Comprehensive Data Strategy:

The strategic use of data is central to modern claims management. The litigation management platform's unique data collection capabilities should be integrated into the carrier's central data repository, enhancing data accuracy and providing a more holistic view of claims processes.

Action Items:

Develop protocols for integrating the structured data from the litigation management platform into the central data repository.

Identify and leverage the unique data categories the litigation management platform provides to gain deeper insights into litigation trends and outcomes.

Implement data governance standards to ensure the integrity and security of the integrated data.

3. Advanced Analytics Plan:

The integration of unique litigation data into analytics processes can transform raw data into strategic insights, driving more informed decision-making and enhancing claims outcomes.

Action Items:

Utilize the integrated analytics capabilities of the litigation management platform, combined with the central data repository, to perform comprehensive analytics.

Develop predictive models and analytics frameworks that leverage unique structured data for forecasting litigation outcomes and identifying risk patterns.

Enhance training programs to equip claims personnel with the skills needed to interpret and act on insights derived from advanced analytics.

4. AI and Generative AI Integration:

The structured data collected by the litigation management platform provides a rich foundation for AI and generative AI applications, enabling more sophisticated automation and decision-support tools.

Action Items:

Explore AI initiatives that specifically leverage the unique structured data from the litigation management platform, enhancing automation and predictive analytics in litigation management.

Pilot generative AI projects that utilize the comprehensive data set for generating legal documents, communications, and research, ensuring ethical use and compliance.

Establish a cross-functional AI governance committee to oversee the ethical use of AI, ensuring data privacy and regulatory compliance are maintained.

5. InsurTech Synergy:

The strategic integration of InsurTech innovations should complement the rich data insights provided by the litigation management platform, creating a synergistic technology ecosystem that propels the claims department forward.

Action Items:

Assess InsurTech solutions for their ability to integrate with and enhance the data and analytics capabilities provided by the litigation management platform.

Implement a pilot to test the framework for InsurTech solutions, focusing on those that can utilize the unique structured data to add value.

Foster an innovation-driven culture within the claims department, encouraging the exploration and adoption of technologies that synergize with the litigation management platform.

Centralizing Strategy Around Data-Rich Litigation Management Technology

Implementing litigation management technology is a strategic move beyond traditional process improvement. It provides a treasure trove of structured data that, when integrated into the carrier's central data repository, enhances every aspect of the claims management strategy—from technology enhancement and data utilization to advanced analytics and AI applications. This holistic approach ensures that the claims department addresses current challenges and positions itself for future innovation and success.

Conclusion

Incorporating data-rich litigation management technology into the strategic plan of the claims department offers a multi-faceted approach to modern challenges in claims management. By leveraging the unique structured data provided by this technology and integrating it into a central data repository, the claims department can significantly enhance its strategic, technology, data, and analytics plans.

This integration not only streamlines litigation management but also lays a robust foundation for future advancements, ensuring the claims department remains at the forefront of innovation and efficiency in the insurance industry.

download thiS WHITE PAPER

Enhancement of Claims Management —A Comprehensive Strategic Plan

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.