Adapt or Strike Out: How the Yankees' Bold Move Mirrors the Future of Claims Management

By Dwayne Hermes

The New York Yankees, a team synonymous with tradition, recently updated a longstanding team rule that restricted players from sporting facial hair. This decision to allow “well-groomed beards,” reversing a nearly 50-year-old policy, signifies more than a style preference—it represents a willingness to evolve and adapt with the times.

Similarly, the risk industry, particularly within claims departments, stands at a pivotal juncture. For decades, the industry has clung to traditional methods like exhaustive claim handling guidelines, reactive bill review systems, and a slow adoption rate of advanced technologies. This paper draws a parallel between the Yankees’ shift and the necessary transformation in how litigated claims are managed, advocating for a proactive and technology-driven approach.

The Case for Change

Just as the Yankees reevaluated their rules to align with modern expectations and team dynamics, claims departments must reconsider their operational strategies. Traditional methods often lead to inefficiencies and missed opportunities for optimization.

Let’s break down the critical areas for change:

Inefficiencies in Traditional Claims Handling:

Reliance on exhaustive claim handling guidelines creates inconsistencies.

Reactive bill review systems result in disputes and delays.

Lack of centralized data hampers real-time decision-making.

The Cost of Outdated Methods:

Increased legal and indemnity expenses due to lengthy claim cycles.

Poor stakeholder satisfaction stemming from slow, non-transparent processes.

Missed opportunities for predictive analysis and strategic planning.

Why Change Matters:

60% of executives say digital transformation is their most critical growth driver (source: PWC).

A report by Gallagher Bassett revealed that 57% of carriers are investing in technology solutions to improve claims resolution times, highlighting the industry's shift towards digital tools to expedite the claims process. (source: Insurance Business)

Measurable Benefits of Technology Adoption

The impact of modernizing claims management isn’t abstract—it’s measurable.

Enhanced Customer Experience:

Implementing digital solutions in the claims process can result in a 10-15 point increase in customer satisfaction, as reflected in NPS scores. (source: McKinsey)

Cost Savings:

Research estimates that automation can reduce claims costs by up to 30%. (source: McKinsey)

Improved Accuracy:

Research indicates that AI-powered automation can drive accuracy improvements exceeding 25%, reduce resubmissions, and deliver actionable insights, thereby enhancing overall claims handling efficiency. (source: MDI Networx)

Employee Productivity:

AI can improve employee productivity by 66%, allowing adjusters to focus on high-level strategy. (source: Nielsen Norman Group)

Why Embrace Technological Advancements?

The integration of technologies like ClaimDeck offers a forward-thinking solution, akin to the Yankees embracing a more contemporary team policy. ClaimDeck, specifically, equips claims departments with tools to streamline their processes, enhance transparency, and improve communication between claims adjusters and attorneys.

ClaimDeck’s platform not only simplifies the compliance with varied and complex guidelines but also enables proactive management of cases through real-time data analytics and collaborative tools.

ClaimDeck Benefits: Driving Efficiency, Collaboration, and Informed Decision-Making

Operational Efficiency:

ClaimDeck revolutionizes claims management by optimizing workflows and streamlining processes — dramatically reducing case cycle times and enhancing overall operational performance. Our technology-driven approach ensures every case is handled with speed, consistency, and precision.

Faster Case Resolution: Streamlined workflows cut down litigated claim cycle times, reducing legal and indemnity expenses.

Consistent Processes: All cases follow an organized framework equipped with best-in-class tools, eliminating inefficiencies and ensuring compliance across the board.

Resource Optimization: By automating routine tasks and centralizing communication, ClaimDeck reduces administrative burdens — allowing teams to focus on high-impact decisions.

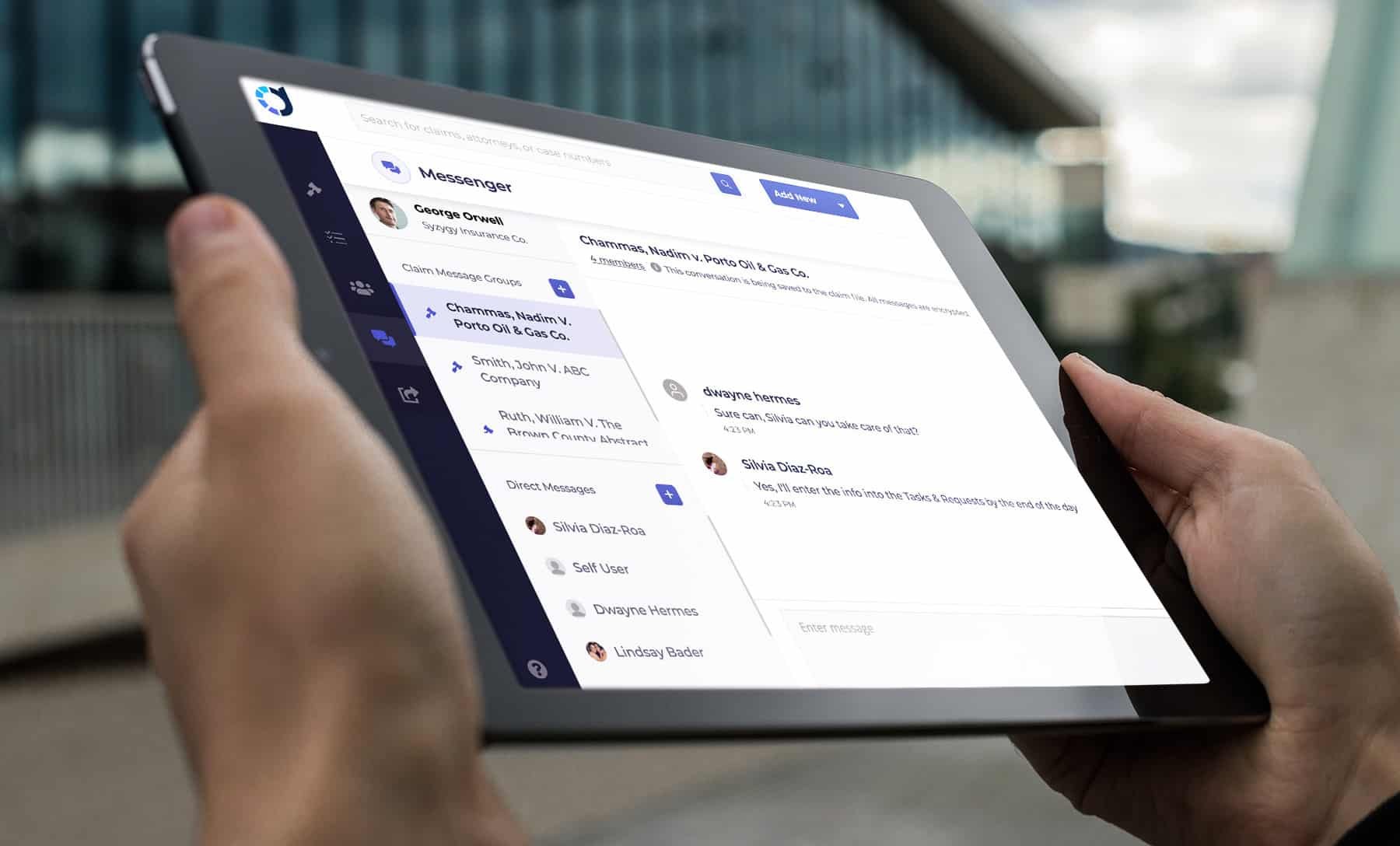

Real-Time Collaboration: Enhanced communication tools bridge the gap between carriers and attorneys, minimizing delays and preventing “assign and resign” scenarios.

Audit Efficiency: Simplified document management and data capture ensure smooth audits and transparent reporting.

Data-Driven Decision Making:

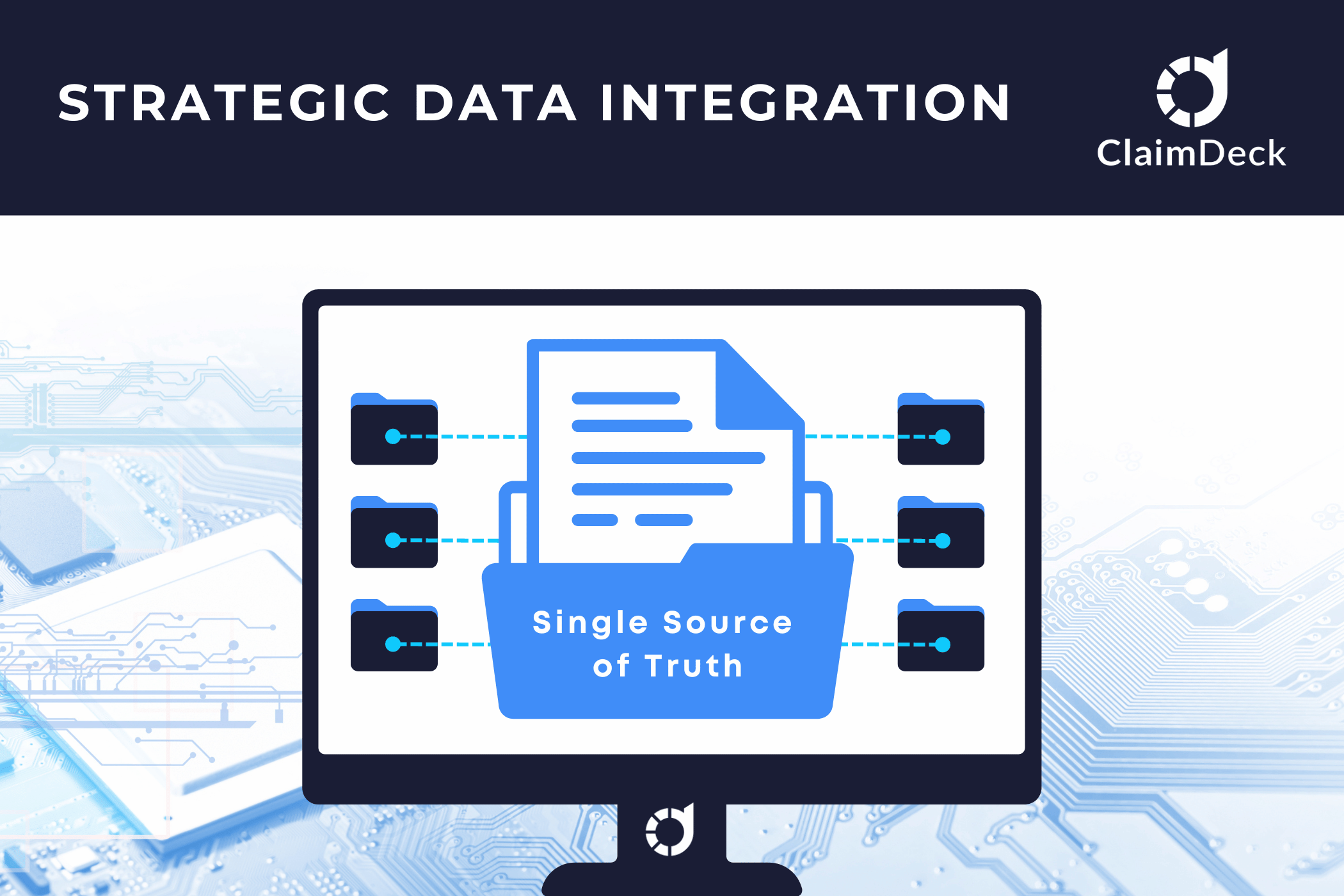

ClaimDeck empowers insurance carriers with precise, actionable insights by capturing and analyzing vast amounts of structured data. This transforms decision-making from reactive to proactive, ensuring strategies are backed by real-time data.

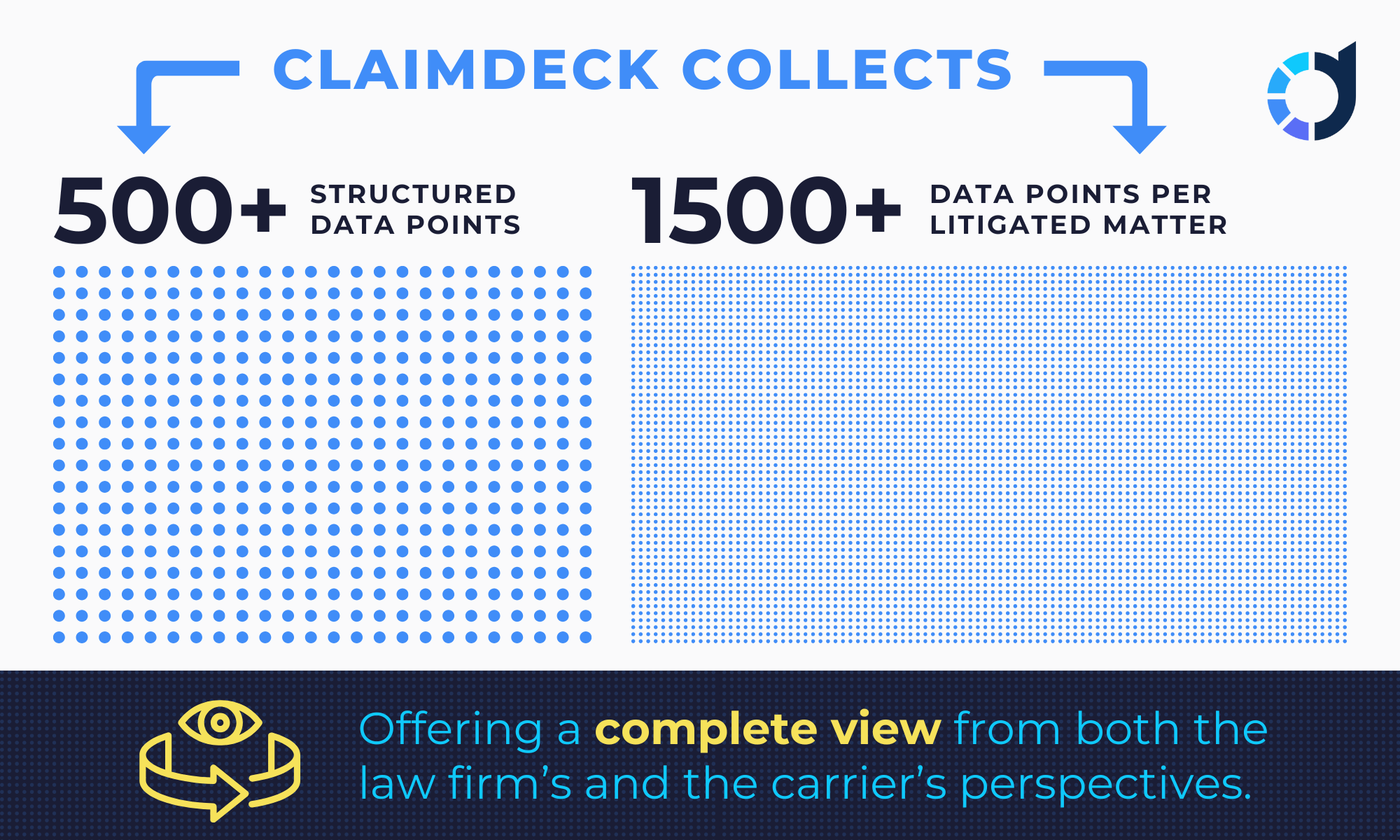

Comprehensive Data Capture: ClaimDeck collects 500+ structured data categories and 1,500+ data points per litigated matter — offering a complete view from both the law firm’s and the carrier’s perspectives.

Informed Case Strategies: Coming Soon, ClaimDeck users will be able to access in-depth analytics to guide case valuations, budget forecasting, and strategic decision-making — reducing the guesswork in complex claims.

Future-Ready Insights: Coming soon, ClaimDeck will leverage historical data to provide predictive recommendations for case outcomes, settlement opportunities, and optimal courses of action.

Continuous Improvement: A built-in feedback loop refines underwriting and reserve accuracy, helping carriers mitigate risk and improve financial outcomes over time.

Collaboration and Communication:

ClaimDeck enhances collaboration by fostering transparency and real-time interaction between key stakeholders, ensuring smoother claims management processes.

Integrated Communication Tools: Strengthen coordination between claims handlers, attorneys, and carriers, ensuring all parties remain informed and aligned.

Workflow Transparency: Clear case tracking reduces misunderstandings and friction, enabling a smoother claims resolution process.

Instant Data Sharing: Eliminates outdated, manual processes by providing real-time access to critical case information, reducing inefficiencies and delays.

Enhanced Stakeholder Collaboration: A centralized platform improves case strategy alignment, minimizing miscommunication and improving outcomes.

Automated Documentation: Digital record-keeping simplifies compliance and enhances audit readiness.

Breaking Tradition: Why Claims Departments Must Adapt to Win

The Yankees’ decision to update their facial hair policy might seem minor, but it reflects a significant cultural shift towards modernization and flexibility. For the risk industry, adopting innovative technologies represents a similar shift—toward smarter, faster, and more effective claims management. As the Yankees have shown, even the most deeply rooted traditions can evolve.

It’s time for claims departments to step up to the plate and embrace the change, ensuring they remain competitive and capable in a rapidly evolving digital landscape.

What’s Next?

We encourage claims departments to evaluate their current processes and consider how technology can not only streamline their operations but also provide significant strategic advantages. Just as the Yankees adapted to the times, so too must the risk industry, leveraging technology to ensure that their practices are as efficient, effective, and forward-thinking as possible.

See ClaimDeck in action!

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.