The Impact of ChatGPT and Litigation Management Technology on Controlling Social Inflation

By Dwayne Hermes

Addressing our struggle to grasp how this emergence of tech, through AI and litigation management technology, is changing/challenging our daily work lives.

Prologue:

This is the second in a series of undetermined articles regarding how Artificial intelligence (AI), like ChatGPT and litigation management tools, can impact the insurance and legal industries’ processes used in resolving litigated claims. (Your level of reaction, as the reader, and general feedback, will determine how many more are to come.)

The first article in the series generated more “buzz” than any other article I have previously shared. This is evidence of all our struggles to grasp how this emergence of tech, through AI and litigation management technology, is changing/challenging our daily work lives. In some ways, it can feel like an existential threat.

As I shared in the prior article, my perspective is that “yes, it is unsettling, to say the least, and I [choose] to attempt to embrace the change rather than let it be imposed upon me.” This is partly due to my controlling nature and, while being more favorable to me, may also be based on my adventurous streak. I would rather dictate and lead the change than try to avoid it and be dragged into the future.

There are professional and financial rewards to be gained from leading and embracing the change. As I acknowledged previously, as a Founder of an insurance defense firm and an Insure/Legal/Tech company, I have a unique perspective on the potential impact of these technologies on the litigated claims process. Maybe this helps me take the more embracing route. I have been on this road that ChatGPT has alerted us all to for a while, so it is easier to react from a more secure place. I hope that my perspective helps you see more of the possibilities, rather than the threats.

Let me share more on what I mean by “that ChatGPT has alerted us all to.”

AI has been present in our daily lives for over a decade – “Hi, Alexa and Siri.” ChatGPT gives us an interface with AI that makes the power of AI available at our fingertips and in our language as if we are speaking to a person on the other side of the keyboard. Instead of asking it questions like “What time is the game?”, we ask specialized and complex questions to which we do not fully know the answers. And we are asking questions that we thought we were experts at answering. And it gives us better answers than we could come up with using our expertise. Unnerving. This makes the capabilities of AI present in a new and compelling way. But the power of AI was there and being used before we had that unnerving interaction; it just wasn’t so readily apparent and so “in our faces” about how “smart” it is compared to us.

This leads to the big kicker

ChatGPT helps us realize the potential uses of AI in almost every aspect of our lives and how it will impact, for many of us, how we do our jobs.

I heard the analogy of when the Internet was first made accessible through Netscape (yes, the OG email address of “aol.com”): it opened the door for the commercialization of the Internet because we, the general public of entrepreneurs, could, for the first time see its applications to our daily lives. ChatGPT is doing the same for AI—a lot to think about and process.

Let's get to the topic at hand – The Impact of ChatGPT and Litigation Management Technology on Controlling Social Inflation.

Social inflation is a growing concern for the insurance industry. This term refers to the increasing costs of:

$ insurance claims resulting from societal factors, such as the changing legal environment

$ more aggressive plaintiff litigation tactics

$ shifting public attitudes toward jury awards

These factors have significantly impacted the insurance industry, leading to a rise in litigated claims and increased settlement costs.

In the previous article, I discussed how at the Claims and Litigation Management Alliance’s annual conference, I had the opportunity to engage in a panel discussion (with Brad Metzger, Melissa Hill, and John Standish) on the potential impact of ChatGPT in general and in particular on the litigated claims process. This follow-up article will delve deeper into the challenges posed by social inflation and explore how AI products, like ChatGPT, and litigation management products, like ClaimDeck, and the use of the data they capture can help insurance carriers mitigate these challenges.

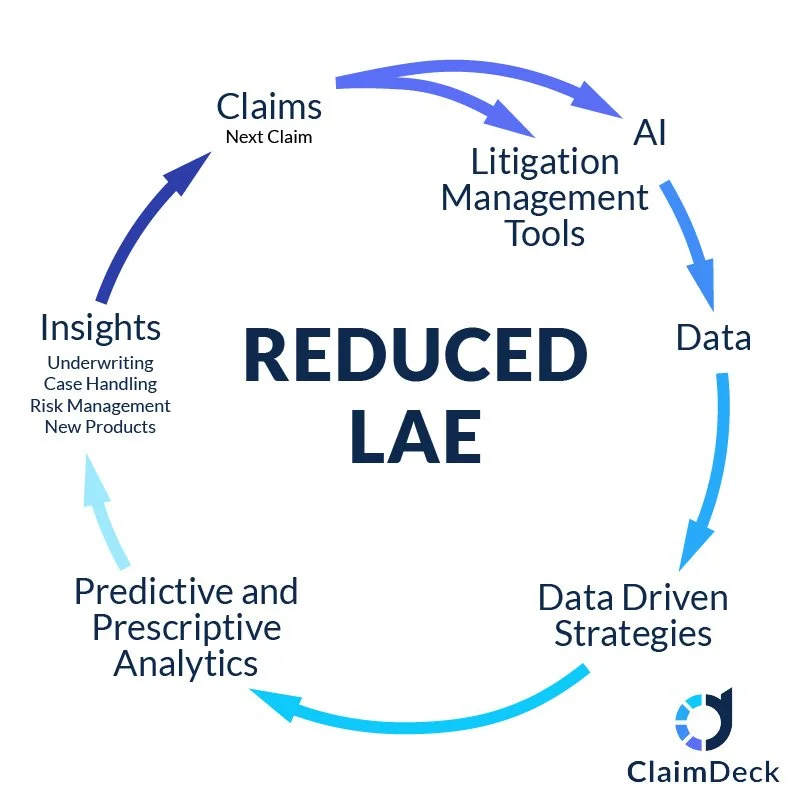

As the insurance industry grapples with the challenges of social inflation, carriers must find innovative ways to manage litigated claims more effectively. AI tools and litigation management technology can offer valuable support in this area. (Just a note that the best litigation management technology will contain AI features. Like ChatGPT made AI “user friendly” by the natural language interface, the best litigation management technology will make the AI “user friendly” in the form of recommendations at the point of predictions and decision making. In this article, I treat AI tools and litigation management technology as separate things for clarity and simplicity.) By harnessing the power of AI and leveraging the vast amounts of data captured through litigation management technologies, carriers can develop data-driven strategies to better control social inflation and its impact on claims costs. These data-driven strategies can then be deployed and measured using litigation management technologies, closing the risk management loop and implementing the continuous process improvement loop.

As an example of AI, ChatGPT, a large language model developed by OpenAI, has demonstrated its potential to revolutionize various industries, including the legal profession.

It is capable of understanding and generating human language with impressive accuracy, which can prove invaluable in assisting litigators and claims professionals in predicting outcomes, developing strategies, and enhancing their overall decision-making process.

As an example of litigation management tools, ClaimDeck (a co-working, web-based, SaaS platform for the claims professional and defense attorney to come together to handle litigated claims) has been shown to have a significant and positive impact on Loss Adjustment Expenses (LAE), by providing technology-enabled processes and granular data capture that drive efficiency and effectiveness for better outcomes.

Processes embedded in ClaimDeck have achieved these reductions, as validated by a capstone project at the Yale School of Management.

The Power of AI

There are several ways in which AI tools can help to manage and control social inflation:

Enhancing human judgment: While human judgment is still crucial in providing litigation services, AI tools like ChatGPT can enhance human judgment by offering objective and data-driven insights that can lead to better outcomes.

Asking the right questions: As AI becomes more sophisticated, the role of legal professionals will increasingly shift towards asking the right questions and implementing the AI-generated answers.

Data-Driven Underwriting: By leveraging AI to analyze data on litigation trends, jury awards, and other factors, insurance carriers can make more informed underwriting decisions. This can help them price policies more accurately and mitigate the impact of social inflation on their profitability.

Embracing the potential of AI: Carriers and legal professionals should embrace the potential of AI, recognizing its ability to improve processes, increase efficiency, and, ultimately, deliver better results for clients.

The Power of Litigation Management Technology

By enhancing and enabling AI products like ChatGPT, litigation management technology can be a powerful tool in controlling social inflation. These technologies allow insurance carriers to streamline their claims management processes, optimize workflows, make tracking case progress easier, identify high-risk claims, improve collaboration within legal teams and with external partners, and control costs. Using litigation management technology to implement these actions can better control the impact of social inflation on their bottom line.

When I reference “enhancing and enabling AI” via litigation management technology, I am referencing the need for an interface where the AI meets the user in the context of their daily work. This will occur often in ways the user is not aware of. For example, when a litigation management tool recommends a case budget or valuation, AI is behind the scenes powering the recommendation. Without the user interface, the AI does not have the opportunity to have a practical impact. AI-enabled litigation management tools provide that interface. The litigation management tool then captures the outcome data on this new case, which feeds into the AI tool to give predictions for the next case.

Litigation management technology empowered by AI can be used to control Social Inflation in a variety of ways:

Data-Driven Decision Making: Litigation management technology can help carriers make more informed decisions by providing insights into litigation trends, emerging risks, and factors driving social inflation. By analyzing this data, carriers can prioritize claims handling, allocate resources to high-risk claims, and develop strategies for negotiating settlements or defending cases in court.

Cost Management and Transparency: Litigation management technology can give carriers real-time insights into legal costs, making monitoring and controlling expenses easier. By tracking costs throughout the litigation process, as opposed to waiting until the end of the case and then using bill review technology, carriers can identify inefficiencies and implement measures to reduce expenses, ultimately mitigating the impact of social inflation on their bottom line.

Enhanced Collaboration: Litigation management technology can improve collaboration between legal teams, claims professionals, and external partners by providing a centralized platform for sharing information and documents. This enhanced collaboration can lead to faster resolutions and better outcomes, helping control social inflation's impact on claims costs. In addition, this approach can be used for early and enhanced intervention arising from early detection.

Improved Efficiency: By automating routine tasks and streamlining processes, litigation management technology can free up valuable time for claims professionals to focus on higher-value activities, such as litigation strategy and negotiation. This increased efficiency can help carriers better manage and control the impact of social inflation on their claims.

The Power of Using Data

One critical aspect of leveraging these technologies is effectively utilizing the structured and unstructured data they generate. Here are some ways that carriers can use this data to address social inflation:

Identifying Patterns and Trends: By analyzing structured data, such as claim types, settlement amounts, and litigation costs, carriers can identify patterns and trends contributing to social inflation. This information can help carriers proactively address potential issues and implement risk mitigation strategies. In addition, carriers can provide enhanced customer service by sharing these insights with their insureds.

Uncovering Hidden Relationships: Unstructured data, such as legal documents, emails, and claim notes, can provide valuable context and insights that may not be immediately apparent from structured data alone. By using AI and natural language processing (NLP) tools to analyze unstructured data, carriers can uncover hidden relationships that drive social inflation.

Predictive Analytics: By leveraging both structured and unstructured data, carriers can employ predictive analytics to forecast potential claims outcomes, litigation costs, and settlement values. These insights can help carriers make more informed and quicker decisions about their litigation strategies, enabling them to better control social inflation and its impact on their bottom line. To drive the point home, by “quicker,” I mean getting to the decision points with less litigation costs.

Benchmarking and Performance Monitoring: By comparing their data to industry benchmarks and best practices, carriers can identify areas where they may be underperforming or face heightened risks. This information can help carriers set performance targets, establish KPIs, and develop strategies for improvement, all of which can contribute to controlling social inflation. The need for standardized benchmarking data industry-wide has been a long-existing frustration for law firms and carriers. At the inaugural CLM Litigation Management Symposium in 2019, the final takeaway, as set out by Taylor Smith with Suite 200 Solutions, was that the industry, both law firms and carriers, needed a single litigation management platform where common benchmarking data could be captured. Combining AI, litigation management tools, and data analytics can remove this frustration and provide industry-wide transparency on performance.

Personalized Litigation Strategies (Prescriptive Analytics): By analyzing data from individual claims and considering factors such as claimant demographics, case complexity, and jurisdiction, carriers can develop personalized litigation strategies that account for the unique characteristics of each case. This targeted approach can lead to more favorable outcomes and help control the impact of social inflation on claims costs. This ability to guide on an individual claim basis will greatly assist lesser experienced claims professionals and defense attorneys and help address the shortage of experienced talent by providing direction and training on a claim-by-claim basis. This will be accomplished by the litigation management technology driving the process with workflows and providing data-informed insights to assist in decision-making.

Enhancing Communication and Collaboration: The data captured by litigation management technology can facilitate more effective communication and collaboration between claims professionals, legal teams, and external partners. Access to the same data and insights allows all parties to work together more efficiently and effectively, ultimately leading to better claims outcomes and reduced social inflation.

Continuous Improvement and Learning: As carriers continue to capture and analyze data from their litigation management systems, they can continually use this information to refine their processes and strategies. This ongoing improvement and learning process will help carriers stay ahead of the curve in addressing social inflation and maintaining profitability in an ever-changing legal landscape.

A significant opportunity for Continuous Improvement and Learning is a postmortem review of cases with extreme outcomes outside of the expected high side of damages (nuclear verdicts). AI and case management tools provide the data, analysis power, and contextual insights to review the causes of unexpectedly adverse outcomes. A detailed review of these outlier outcomes can help put prevention measures in place, refine future valuations, and identify resolution points that may be overlooked, thereby predicting and preventing.

Enhanced Claims Triage and Decision-Making: AI can help insurance carriers quickly and accurately triage claims, determining which claims are more likely to result in litigation. By using AI to analyze historical claims data and identify patterns, carriers can make better-informed decisions about handling potentially litigated claims.

Early Detection of Fraudulent Claims: AI can help carriers detect fraudulent claims more effectively by analyzing patterns and trends in claimant behavior. This can prevent carriers from overpaying on fraudulent claims or spending excessive resources on litigation.

Conclusion

The impact of the AI discussed is that the technology is providing the tools to streamline the claims handling processes, enhance decision-making, and utilize data to its full potential. As it continues to “learn” through the application of the tools, the usage contributes to a more sustainable and profitable insurance industry. Carriers that embrace AI tools like ChatGPT, and litigation management tools like ClaimDeck, which effectively harnesses the plethora of structured and unstructured data, will be best positioned to navigate the challenges of social inflation.

Click here for additional thought leadership articles by Dwayne Hermes

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Contact Dwayne at dwayne@claim-deck.com.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.