Closing the Loop: Process Improvements for Claims & Underwriting

The insurance industry has long been aware that there are benefits from connecting information (what we used to call “data”) between claims and underwriting departments. What this connection has looked like has varied over the years industry-wide and within individual carriers. Sometimes it was done simply by the physical proximity of those handling claims to those doing underwriting. This proximity has taken a new look with the movement to remote work. The challenge of this information sharing continues today.

How can the relevant data within claims, not just as to a particular claim and insured, be captured, packaged, and shared to effectively and appropriately influence the underwriting decision? Is this the Multi-Million Dollar Question? It certainly is one of them. ClaimDeck’s data capture is a part of the answer.

Asking the Proper Questions

As data capture regarding our activities and environment exponentially increases, carriers are motivated to use this data to improve underwriting and provide cheaper and customized pricing for their target client base. The increase in captured data has led to the proliferation of data sources and the expenditure of carrier funds to purchase this data.

Questions to ask:

Is an equivalent effort being made to capture and mine the available data within the carriers’ claims?

Is the purchased data better than the data available within the organization?

Isn’t it good common and business sense to capture this internal claims data for underwriting use?

What about capturing and using the data from the defense firm side of handling claims?

Understanding Cause = Minimization of Risk, Greater Retention

By watching any sporting event on TV, you immediately sense the intense competition by carriers for customers. There is a striking volume and variety of slogans, jingles, characters, endorsers, and themes to entice individuals to become insured customers. With the industry spending this level of hard-earned premium dollars to attract insureds, what is the equivalent spend to keep them once they have signed on? Particularly those that have had claims? Or even books of business that have underperformed?

Rather than determining from an underwriting perspective not to renew an insured because they have had a claim, wouldn’t it be better to understand the cause of the claim and enter into a collaborative relationship with the insured to avoid future claims? Maybe this would come with a premium adjustment, but not with an ending to a relationship that was costly to obtain. This understanding of the cause of the loss provides a basis to improve the individual insured's risk profile and the insurer's book of business. Until now, capturing the information to drive this process was difficult.

The Right Tool for Achieving Granularity

Even though there are competitive underpinnings to rates, there are also regulatory restraints that dampen this competition. So isn’t there a good business and societal motivation to allow a level of the joint effort to deliver the best-priced product to the customer base? Currently, underway is an effort to customize premiums to a granular level for each insured and risk profile. How could this effort be accelerated and improved for the insureds and the industry? The anonymization and amalgamation of granular claims data across the industry would contribute substantially to the success of this effort. ClaimDeck is making this desired state a reality for its users.

To connect with a subject matter expert on our team, click below or email demo@claim-deck.com.

About ClaimDeck

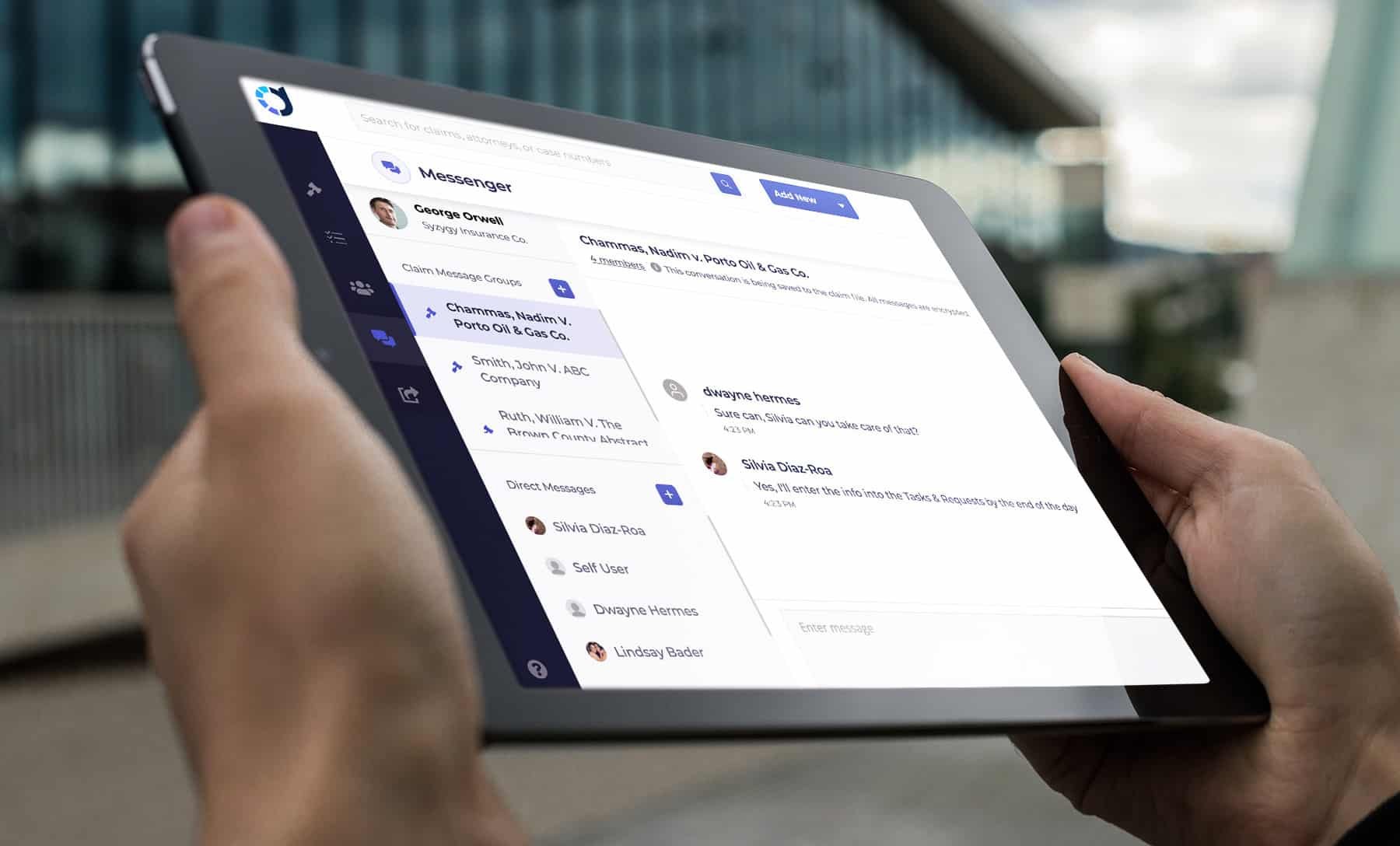

ClaimDeck's approach is modernizing the litigated claims process by enabling more efficient and transparent communication between the attorney and claims professional, allowing for real-time, self-help access to information, as well as providing compliance monitoring and auditing capabilities. The secure, user-friendly platform tackles the inefficiencies in the claims litigation processes by bringing transparency, control, uniformity, and data analytics, thereby enabling continuous process improvement to reduce indemnity, legal spend, and claim life.